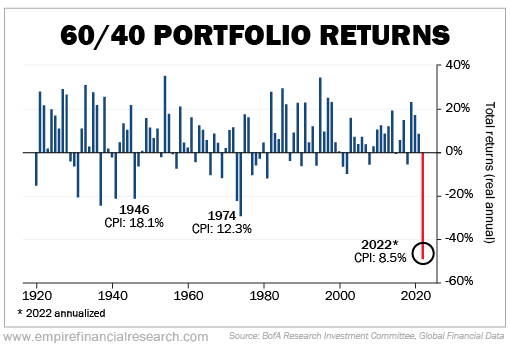

The capital markets have recently experienced unprecedented uncertainty, from stagflation to geo-political risks. After decades of friendly stock and bond market returns, it has become much more difficult for investors to navigate all the potential landmines and manage portfolio risk. There has been much press on the reversal of fortune of the noted 60% stock and 40% bond portfolio over the last year.

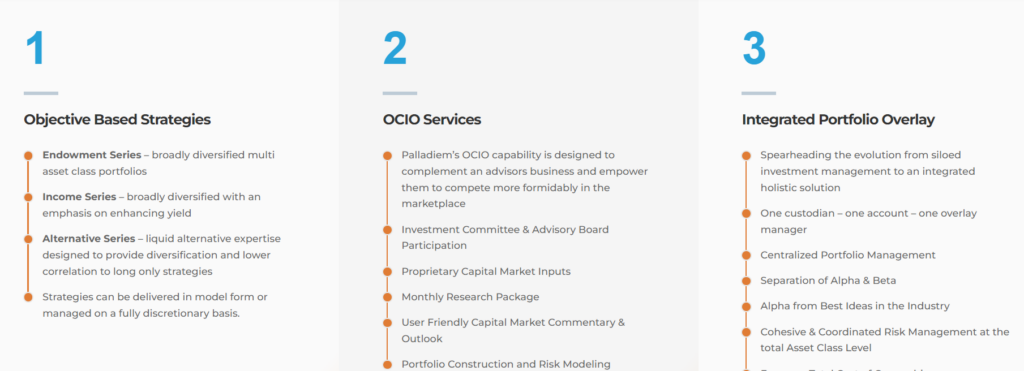

Now is the time to engage with entities that truly understand the drivers of risk and return for diversified portfolios given the oncoming headwinds. We recently published two insight pieces on our view of the “New 60/40” moving forward.

Please refer to the following link to review our proposed approach to asset allocation and managing risk:

A Trusted Partner...

Palladiem has a long-term track record of running diversified, liquid alternative investment strategies to offset the risk of holding traditional equity and fixed-income positions.

These strategies replicate risk/return characteristics of three active hedge funds (at a fraction of the cost, daily transparent, daily liquid, and no K-1 reporting requirements); Absolute Return, Multi-Strat, and Global Macro.